Content

The more effective a firm’s processes, the better they will avoid compliance headaches, audits findings, and other regulatory issues, as well—all key value drivers for a SaaS business. Every team member must understand their role and how it impacts valuation. This begins with your Head of Finance ensuring department heads are fluent in SaaS metrics and are clear on the KPIs they own. As department heads, their role in due diligence is to add value by demonstrating how they are using SaaS metrics and how that will continue under new ownership in a way that creates even more value.

- Ideally, when selecting an accounting software, you want to make sure that it can adapt to your company’s growing needs.

- It looks at the value of a contract and anticipated income ahead of payment completion.

- You can choose payment methods that are less expensive than international wire transfers.

- This drastically simplifies your journals as you do not need to worry about accounts payable or accounts receivable.

- This method is easy to use, simple to maintain, and suitable for small businesses or those with little inventory or customer base, but not recommended for SaaS businesses.

- [Numeric] think about the month-end close as a little bit less of a workflow and compliance process.

The critical decision for high-growth SaaS companies is when to move from accounting software like QuickBooks or Xero to a more robust one like NetSuite. Given the horror stories about NetSuite implementation and the fact that you can get quite far with QuickBooks, people often delay this upgrade. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. For SaaS companies, like other companies, you need to track expenses and manage corporate spend, while matching expenses with related revenues using the accrual method of accounting. Economic nexus may be triggered by an annual transaction threshold or a sales amount threshold in another state (or even a city within a state), with the jurisdictions determining the rules. Economic nexus applies to sales tax in several states, to corporate income tax in Hawaii, and to gross receipts tax in Washington state, according to Moss Adams.

How do SaaS startups recognize revenue from annual contracts that are paid upfront?

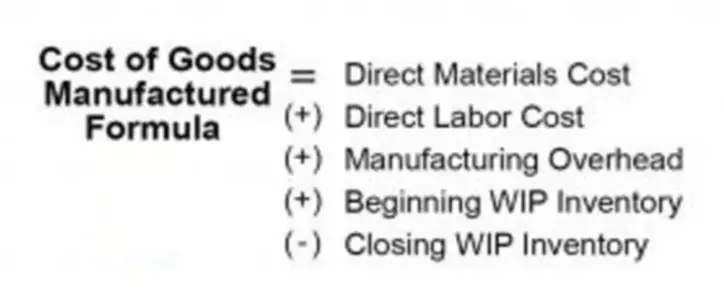

Like revenue, expenses are recorded when a contract is established and not when incurred. If a SaaS has high bookings but lower billings, it is a leading indicator of future cash flow problems. To maintain healthy cash-flows, SaaS businesses have to think of ways to get customers to pay upfront and increase billings. Booking is a forward-looking metric that typically indicates the value of a contract signed with a prospective customer for a given period of time.

Monthly Recurring Revenue (MRR) is an important metric for SaaS businesses and Accrual accounting suits subscription businesses because accrual revenue, if recognized correctly, actually tracks the MRR. Since it allows tracking revenues and expenses together in the same period, it provides comparable trends for SaaS businesses. If your SaaS business has high bookings but lower billings, this can be a leading indicator of future cash flow problems. You can find this information easily by generating detailed statements of cash flow on a regular basis, which is discussed a bit more below. Trying to get monthly customers to be annual customers through discounts, or otherwise compelling customers to move up their payments is a good way to avoid this issue.

What To Look For In Startup Expense Tracking Software

With ambiguity in tax laws, minor differences can change a company’s tax treatment of customer contracts. It is difficult to scale a SaaS model without the extra revenue afforded by boosted features and promotions. But they create complex accounting scenarios where you are recognizing pieces of revenue, for the same customer, in different periods. A bonafide SaaS accounting system will take the hassle out of mods to your contracts and normalize them on books. So that you are always recognizing revenue correctly as performance obligations are met. SaaSOptics is a subscription management integration targeted at B2B SaaS companies.

The primary difference between the two is when sales revenue is recorded in the income statement. Revenue recognition is one of the principles of the Generally Accepted Accounting Principles (GAAP US). It provides saas accounting the condition under which revenue is recognized and a way to account for it in the financial statements. But before we go deeper into revenue recognition for SaaS, it is important to understand some key concepts.

Solutions

While you cannot expect to become a millionaire overnight just from selling a SaaS accounting solution, it offers something unique to the market that businesses are willing to pay for. Because the cost of typical software development, including building a SAAS accounting software depends on many factors. An experienced SaaS solution development company will offer you business analysis (BA) services and provide you with the best solutions to unlock and grow your desired market. According to Gartner, the SaaS industry is projected to grow to a staggering $121B in 2021, a 15% increase from 2020.And this trend will continue. Based on a 2019 survey, Gartner forecasts that eighty-four percent of new software will be delivered as SaaS, and this percentage is expected to increase as existing providers transition to a subscription-based model. Yet, many software providers are ill-prepared for the unique challenges and opportunities that come with managing customer subscriptions and transitioning to a SaaS model.

However you choose to hire a SaaS CFO, it can be a slow and difficult process. The last thing you want is a CFO who does little more than provide basic accounting oversight. A thorough list of SaaS CFO interview questions will be a valuable tool in your search, as the duties of a SaaS CFO run deep, and you’ll want to make sure a candidate is up to the task before it’s too late. Deloitte also provides the Deloitte Accounting Research Tool (DART), a comprehensive online library of accounting and financial disclosure literature to clients. In this Technology Spotlight, you’ll find scoping considerations for entities determining whether software and software-related costs incurred should be accounted for under ASC , ASC , or other US GAAP. This is the first publication in a series that will further examine the application of the relevant guidance, including common issues and complexities.

You’ll need to figure out step three first before allocating the transaction price. Depending on your subscription model, the transaction price can be broken down into smaller chunks. Recognizing deferred revenue before fulfilling your contractual obligations can lead to inaccurate growth forecasts, which, as we know, is terrible for business. Revenue recognition is a big part of the GAAP standards we mentioned above.

- It manages the intricacies of long sales cycles, with many customer touchpoints, and varied pricing models.

- For example, Key Accounts Receivable, Profit and Loss Summary, Accounts Payable, Revenue, Expenses, and Invoices.

- This ongoing collaboration is the preamble to effective accounts receivable (AR) management.

- It occurs when clients pay for your product up front and before you deliver services.

- This can be over a certain time period, for instance over a month or the whole year.

- We are seeing plenty of slam-dunk seed rounds happening with SaaS startups that have $100k+ in ARR and good growth.

High-quality accounting provides unparalleled insights into financial data that defines the future of your business. Access to this data enables leaders to make decisions faster and with greater levels of confidence, paving the way for continued growth. In this example, the sales team has sold a contract worth $100,000 to provide your SaaS product to a new customer for a period of one year. Let’s take a look at each of them, using the hypothetical example of a SaaS business that has signed a $100,000 year-long contract with a major new enterprise customer.